What I Wish Everyone Knew About REITs

A good real estate course can prepare with the tools necessary to succeed in real estate. You have to decide how much education you want to obtain and what type of education you will pursue.

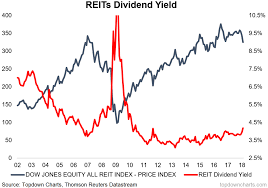

Why do I like real estate stock investments? Very simple – DIVIDENDS! There are some reits out there that pay a 14% yield in dividends in addition to whatever capital gains you may receive. Sounds a lot better than that 1% yield at your bank account, right? If you look around you’ll find some good investments paying 5% or more in interest… this will help you pick up the pace in building your savings.

Books are great way to gain knowledge fast. But I am sure you already know that and have read at least 10 books on real estate investing prior to getting started. Right? Or are you one of those individuals whose television is larger than their library of books! I would recommend a quick trip to your local bookstore, or online book seller to quickly expand your library. Your “Actions will be Rewarded.” So… consider this… would you prefer to be judged based on the size of your television set or the size of your library? Now is a good time to start stocking your library…wouldn’t you agree?

I hope this list gives you the knowledge it has given me. If you learn and apply what you have learned from these books there is no reason that you should not become very successful.

In three years, Ollie had almost filled up his park with new mobile homes and increased rents to $395; almost $295 more per lot than he is paying on his master lease to the owner. In so many words, he made money filling up the park, raising the rents, and selling new mobile homes. He was only able to do this because he offered the units at prices that his competitors couldn’t primarily because he controlled the space where they would be set.

It is interesting to see how money can grow over the long haul. This why financial advisers tell you to start investing early in life. For example, assume that when you are 20 years old you invest $10,000 and add $10,000 to your investment every year until you are 65. Assuming that you earn 5% a year you can expect to the money to grow to $1,766,701. Now, lets assume you are 40 years old and want to retire at 65. So you invest $10,000 initially and then $10,000 every year for 25 years and earn 5%. Your money will only grow to $534,998. See what a difference the 20 years makes? If you started at age 20 versus 40 you would over 3 times the amount of money.

Simplify your investment search by opening a mutual fund account with one or more of the largest mutual fund companies in America. You will then have virtually all of the investment options you’ll ever need at your finger tips; and will be working from a much shorter list of choices, all arranged by category and subcategory.

In any market, not just the stock market, poor timing spells ‘bad investment’. Another advantage to investing in a fund vs. a physical property is that you can invest over time to smooth out the risk. If prices fall you can add more shares at a cheaper price while waiting for the recovery.

To see other passive income ideas, click here

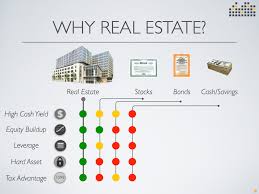

The 15 Best Real Estate Investing Strategies*

| 1 | Fix-and-Flip |

| 2 | Wholesaling: quick flip |

| 3 | House Hacking: renting out part of house |

| 4 | Live-In-Then-Rent |

| 5 | Live-In-Flip |

| 6 | Buy-Remodel-Rent-Refinance |

| 7 | Short-Term Buy and Hold Rentals |

| 8 | Long-Term Buy and Hold Rentals |

| 9 | Payout down rental mortgage |

| 10 | Buy a rental property without any debt |

| 11 | Trade-Up |

| 12 | Hard Money Lending |

| 13 | Discounted Note Investing |

| 14 | Pooling your money with other investors |

| 15 | Real Estate Investing Trusts (REITs) |

*source: Coachcarson.com

3 High-Yield REITs To Buy

Typically, a higher profit yield implies a stock has a higher danger profile. In any case, that is not generally the situation. Top-level land speculation trusts (REITs) AvalonBay Communities (NYSE: AVB), Boston Properties (NYSE: BXP), and Federal Realty Investment Trust (NYSE: FRT) all right now yield over 4%, which is well over the 1.7% normal yield of a stock in the S&P 500.

What makes those better than expected payouts stand apart is their strength, as these REITs back their profits with a top notch portfolio and a top-level accounting report. That blend of yield and supportability make them extraordinary choices for money looking for speculators to purchase this September.

AvalonBay Communities is one of the biggest condo REITs in the nation. It right now possesses 295 condo networks (counting 19 being worked on) containing 86,380 homes in 11 states and the District of Columbia. The organization regularly claims lofts in profoundly attractive areas like significant entryway urban communities (Boston, New York, and Los Angeles) where populace and work are extending at a better than expected pace. This will in general produce solid rental development rates.

The entirety of this empowers AvalonBay Communities to deliver an alluring profit that at present yields 4%. The organization bolsters that payout with a traditionalist profit payout proportion (68% of its FFO over the previous year) and asset report. It has one of the most noteworthy FICO scores in the REIT segment, upheld by a sensible influence proportion of 4.9 occasions obligation to-EBITDAre. That solid money related profile puts its high-yielding payout on unshakable ground. Thus, it’s an incredible method to put resources into private land without all the cerebral pains that accompany being a proprietor.

Office REIT Boston Properties at present yields 4.5%. One explanation it has such a high return these days is that the stock has been feeling the squeeze this year, falling about 38% on worries that telecommute patterns will pulverize inhabitance and rental rates over its portfolio.

While a few organizations state they intend to permit their representatives to telecommute even after there’s an antibody for COVID-19, most bosses and office laborers despite everything lean toward in-office work. Hence, organizations keep paying rent on their office space despite the fact that they’re not utilizing a large portion of it right now. That is giving Boston Properties the money to keep delivering profits and put resources into its huge record of improvement ventures. Include its first class asset report, which like AvalonBay highlights An appraised credit and a sensibly low influence proportion, and its high-yielding profit resembles it’s on unshakable ground.

Economic situations in the retail part were at that point extreme before this year, when they turned out to be frightfully whole-world destroying after governments constrained numerous stores to near assistance moderate the spread of COVID-19. Thus, many couldn’t produce any business, which affected their capacity to pay lease.

That issue burdened retail REIT Federal Realty Investment Trust, which just gathered 68% of the lease it charged during the subsequent quarter. Thus, shares tumbled over 38% this year, which pushed its profit yield up to 5.3%.

In any case, regardless of the organization’s issues during the subsequent quarter, it had enough trust in its monetary record (which additionally includes An evaluated credit) and the ongoing enhancements in its rental assortment rates to build its profit. That denoted the 53rd back to back year it gave its financial specialists a raise. Having the option to do so kept it in a tip top gathering of profit payers, as it’s just one of 30 that have become their payout for at least 50 straight years.

Numerous REITs deliver a high-yielding profit, as the part’s present normal is about 3.7%. In any case, not every one of those better than expected payouts merit purchasing since some have maintainability issues. In any case, that is not the situation with this trio, as they gloat probably the best asset reports in the area. Thus, they offer speculators unshakable significant returns, which makes them extraordinary alternatives for money looking for financial specialists to think about purchasing this month.

I have a a Great Course for you on Real Estate Investing! CLICK HERE

Related Posts

-

Understand The Background Of Investing Success Now

No Comments | Aug 14, 2020

Understand The Background Of Investing Success Now

No Comments | Aug 14, 2020 -

What to sell on Etsy

1 Comment | Sep 27, 2020

What to sell on Etsy

1 Comment | Sep 27, 2020 -

The Ultimate Revelation Of Investing Tips.

No Comments | Jul 26, 2020

The Ultimate Revelation Of Investing Tips.

No Comments | Jul 26, 2020 -

Penny Stock Investing: Ten Basic Rules

No Comments | Aug 6, 2020

Penny Stock Investing: Ten Basic Rules

No Comments | Aug 6, 2020