Understand The Background Of Investing Success Now

While this might sound like a bold claim, it is true. After years of trying nearly everything out there, I can say without reservation that the key to investment success no matter the market or time frame is the ability to recognize technical divergence.

Okay, you made your first solo investment so what do you get? What you get is about 0.30 cents back instantly and a link to promote and for each $1.95 you invest here’s the deal… promote that link sign on at least 3 active members from that link before investing anymore solos you will earn money on their investments when they do the same.

If you feel like you’re feeling your way as you go, then it sounds more like someone talking about a hobby than a serious business! There’s far too much to chance! Where is the discipline? Where’s the perfect practice? Where is the relentless application and drive to improve, succeed, and exceed?

With each day, all you are experiencing is experience itself and you can choose to call it a loss, a failure, an error, a lucky win, a screw-up…but let me offer something else…

I can only conclude that the secret to Tiger’s success isn’t actually a secret at all: It’s hard bloody work! Time spent practicing, which gives you experience, which gives you confidence, which gives you…you guessed it…talent! Who would have thought it would be so easy (hard!)?

Some people, especially those new to real estate investing, have not been spared by this infectious “I want it now” mentality. Satellite dishes, cable, the Internet, pagers, cell phones, fax machines and, of course, email. Is it any wonder they just naturally expect to achieve instant results? It’s become a way of life.

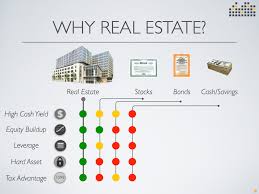

The above list says it all. I think you will have quite a bit of difficulty locating another investment that offers all the above points. Of course, you might be skeptical. And that’s fine. Most people are. You need to find out if it’s legitimate on your own.

Think very carefully through what I’m about to say. Http://Babieboomers.Com is not the only choice. There are many other Investing success brands. Etch it into your mind and heart. Follow it faithfully and you will come close to guaranteeing your Investing success. Forget it at your peril.

Therefore, it is absolutely imperative that building the right Mental Approach is on your ‘to do’ list. In fact, it should be FRONT AND CENTER. You can work on that in parallel with your Method and Plan, and as you gain experience in the market.

First, market values. You must thoroughly understand the market values in the neighborhood where the property is located, so that you can project an accurate After Repair Market Value (ARMV). In other words, how much will this property sell for after all needed repairs and upgrades have been completed. While it is beyond the scope of this article to cover market value in-depth, I will simply note that the one best way to determine the ARMV of a residential property is to compare similar properties in the neighborhood which have sold recently (called comparables or “comps”).

To see stock investing tips click here

10 Tips for Investing Success*

| 1 | Regularly save and invest 5 percent to 10 percent of your income |

| 2 | Understand and use your employee benefits |

| 3 | Thoroughly research before you invest |

| 4 | Shun investments with high commissions and expenses |

| 5 | Invest the majority of your long-term money in ownership investments |

| 6 | Avoid making emotionally based financial decisions |

| 7 | Make investing decisions based on your plans and needs |

| 8 | Tap information sources with high quality standards |

| 9 | Trust yourself first |

| 10 | Invest in yourself and others |

Superinvestor’ renowned Arnold Van Den Berg says esteem contributing is the best way to deal with gather riches in the long haul, as it isn’t mainstream with the majority and gives chance to financial specialists to purchase stocks at great deals.

“Worth contributing doesn’t speak to the majority. On the off chance that it did, you could always be unable to purchase a deal,” he said in an introduction at Talks at Google.

Van Den Berg feels the worth contributing methodology can be utilized for a speculation, regardless of whether it’s stocks, bonds, land, wares or even a personal business.

“The key to understanding worth contributing is to make sense of what a business is worth, and afterward fundamentally purchase that business at a ‘discount’ or limited value,” he says.

The worth contributing legend takes note of that stocks selling underneath their characteristic qualities – deal stocks – are typically discovered distinctly during seasons of incredible vulnerability, and speculators who can detect these stocks get remunerated once the market vulnerability dies down.

“Due to the dread encompassing vulnerability, numerous individuals are eager to sell stocks well underneath inherent qualities and as a rule at clearance room costs. Commonly, this happens on the grounds that an organization, an industry, or now and again the market everywhere have an issue, which is typically impermanent. In any case, history has demonstrated that financial specialists who purchase these deals will every now and again be remunerated when the vulnerability clears up,” he says.

Arnold Van Den Berg is the Founder and CEO of Century Management and fills in as Chairman of the CM Advisors Family of Funds Board of Trustees. With long periods of industry experience behind him, he still effectively oversees venture techniques at the firm.

In spite of the fact that Van Den Berg had no proper advanced degree, his broad market information can be ascribed to thorough self-study and huge devotion.

He started his vocation by working for a few budgetary administrations organizations, however before long understood that he needed to be in a business that he adored and at a spot he put stock in.

He was interested why during the securities exchange crash in the mid 1970s a few assets went down short of what others. In the end, he found that those assets were improving in light of the fact that they concentrated on esteem contributing. So in 1974, at the base of the market, having at last discovered a venture reasoning he could have faith in, Van Den Berg began Century Management.

“I started to examine numerous venture ways of thinking to attempt to increase a superior understanding with respect to why endless directors went down such a great amount for such a long time. What I found was that esteem directors, for example, Benjamin Graham and especially his devotees, secured their customers’ capital better and gave more steady venture results than administrators utilizing other speculation techniques. Moreover, esteem contributing impacted me at an individual level as it seemed to be, and still is, reliable with how I carry on with my own life. Around then, I figured I was either going to rake in boatloads of cash or it would have been the apocalypse,” he says.

Van Den Berg says the venture business isn’t just about riches the board, yet additionally life the executives as wise speculation counselors likewise engage in wellbeing, riches and way of life issues of their customers.

Discussing what venture reasoning his organization has confidence in, Van Den Berg says he just attempts to adjust his very own speculations to those of his customers, as it goes far towards eliminating irreconcilable circumstance and keeps everybody concentrated on making the wisest decision for customers.

Profit by esteem gapsVan Den Berg says the primary focal point of financial specialists ought to be to perceive and benefit from esteem holes. Basically, esteem hole is the contrast between the cost of a stock and the fundamental estimation of the business.

The incredible financial specialist says he accepts that in the short run, market gyrations move stocks everywhere, except the hidden estimation of a business is the thing that characterizes cost over since quite a while ago run.

Worth holes occur in all ventures and all segments. They occur in little just as enormous organizations. They can happen each in turn, or at the same time in significant market plunges. It is consequently that he generally encourages speculators as far as possible their ventures to any market-top size or segment of the market and urges them to contribute any place they may discover esteem, he says.

Never anticipate the market Van Den Berg additionally cautions speculators against foreseeing or timing the market, and encourages them to maintain their attention on purchasing organizations at appealing costs.

“The greater part of the individuals who have gathered the best riches in this business have done so not by foreseeing the future, yet by purchasing organizations at such appealing costs, and along these lines limiting most of the issues individuals dread. What’s more, as normally occurs throughout everyday life and furthermore when purchasing stocks, the majority of our apprehensions are rarely figured it out. At the point when speculators own organizations at costs that as of now reflect existing and future issues, as a portion of those issues never emerge, they probably end up with pleasant benefits and in this manner we ought to comprehend and welcome that the best riches is made in purchasing incredible qualities, and not in attempting to foresee the future,” says he.

The amazing speculator likewise rattled off certain exercises that he has gotten the hang of during his venture:-

Perusing assists make with bettering speculations

It is significant for financial specialists to find out about the same number of organizations as they can, and try to keep awake to date on the ones that premium them from a contributing point of view. As financial specialists read increasingly more about various organizations, they begin getting a decent feeling of which enterprises have alluring plans of action and which ones have inferior plans of action and that can assist them with settling on better speculation choices.

Self-control key supporter of achievement

Self-control is a key factor that adds to a financial specialist’s accomplishment throughout everyday life and in contributing. The most self-restrained individuals are bound to accomplish their objectives than others. Control in contributing methods continually considering the most dire outcome imaginable just as restrained purchasing and selling and edge of wellbeing. The most dire outcome imaginable has a higher likelihood of occurring than anticipated, and when it occurs, it’s quite often more regrettable than anticipated.

Be cautious about utilized organizations

He says the main exercise he has picked up during his whole contributing vocation was to be careful while putting resources into utilized organizations which frequently bring about the most capital misfortunes. “There are commonly when financial specialists would initially purchase an organization and the monetary record would look traditionalist. Be that as it may, the supervisory crew of the organization at that point continues to get forceful in giving obligation and the asset report crumbles, regularly because of an enormous procurement. Not being sufficiently touchy to the disintegrating monetary circumstance of these organizations can make financial specialists lose cash.

As such, speculators ought to stay cautious as the edge of security that is there at the buy date may vanish after a significant change in budgetary influence,” he says. It is fundamental for financial specialists to follow great standards and ethics in life as it improves them prepared to take significant business choices. “Ordinarily in business and in life you get into a circumstance requiring a genuine choice. On the off chance that you have the correct way of thinking, you’ll settle on the correct choice. I was resolved I would build up the rules that would direct my life so that, god deny, on the off chance that I at any point got into a position where I needed to settle on a urgent choice, I would decide to satisfy the standards,” says he. There are times when speculators need to settle on extreme choices which may not really be beneficial for them yet it might be the best activity. Van Den Berg urges financial specialists to heed their gut feelings and settle on the correct choice as things never turn out badly when right choices are taken. “At the point when you should settle on a choice that is not really bravo but rather it’s the correct activity, you’ll never turn out badly making the best choice. In the event that you make the best decision, things will turn out to be better regardless of whether you don’t think so at that point. That is the thing that guided me, and that is the thing that despite everything persuades me today,” he says. So as to turn into an effective speculator, it is significant for financial specialists to be completely centered around the errand. As the market is commonly unpredictable temporarily, speculators can confront a ton of high points and low points in their venture excursion and it is just outright concentration and resolve that can make their brains inconceivably amazing to manage outrageous conditions.

Study the psyche mind

To accomplish this extraordinary degree of center, it is basic to do broad investigation of the psyche mind, which is the way to opening a person’s latent capacity. “You can pick up in your life – regardless of whether it’s contributing, in marriage, in family, in companions – by considering the psyche mind. The psyche mind doesn’t think, it acts. It’s much the same as composing into a PC,” he says.

Sharing his own understanding, he says that he has taken in three significant exercises from his investigation of the psyche mind which has helped him improved as a speculator.

- Be absolutely legit with yourself. To capitalize on the psyche mind it is imperative to remain absolutely fair with oneself. “You can’t delude yourself. Provided that you do, your life will get wrecked and befuddled. In any case, on the off chance that you have a fact, in the event that you generally adhere to a similar guideline and you work that rule consistently in your psyche, your psyche brain will program you into the sort of individual you need to be,” he says.

- Have faith. Another significant discovering that Van Den Berg has had from considering the psyche mind is that it is basic to have confidence and the conviction to accomplish one’s objective and vision. “We find through contemplating the psyche mind that conviction is ground-breaking to the point that it can impact your qualities and DNA. Conviction is the absolute most significant thing throughout everyday life,” he says.

I have a GREAT Course for you on Investing Success From a Millionaire!