Nine Innovative Approaches To Improve Your ETFs

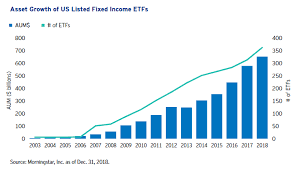

Let’s be sure you know what an ETF is. It is an Exchange Traded Fund. They have not been around very long, but are catching on. More and more are being created.

Although ETFs charge a management fee, fees for ETFs are significantly lower than mutual funds or even index funds. Look into mutual funds and you’ll start to realize the exorbitantly high fees. With an ETF, it’s typical to only pay between 0.1% and 0.7% of your total assets. This is music to an investor’s ears if he/she is “cost conscious.” Personally, I am fundamentally opposed to paying fees higher than 0.5%. I mean, think about it, you wouldn’t want to throw money down the drain would you? Over the long haul, fees can nickel and dime you, and eventually take a significant portion of your retirement portfolio. ETF’s are also more tax efficient than mutual/index funds.

You could buy the short ETF for $50 or you could buy a put option for $5. It requires a lot less capital and therefore it allows you to have a smaller possible loss. If you own the short ETF and the market gaps to the upside it can be potentially deadly to your account. But if you bought the put the most you can possibly lose is the $5 you put into it.

By now, many investors see the importance of having a strategy for making money when the market is dropping. Most investors have yet to develop this strategy. We prefer to do it with simple index trades. Whatever you do, find a way to make your own moves and don’t depend on someone else to invest your money for you. No one will take care of your money like you will!

An ETF has a market price, just like a stock. It is traded in regular trading hours, just like a stock. It has a bid and ask prices, just like a stock does. When the bid and ask price meet we have a transaction. And each ETF has its own name and symbol making it easy to differentiate between the two.

That makes it a good candidate if you want to hold onto it for a while and sell some calls on it. At least you know it will still be around in 5 years.

Innovation is the key to success. For now, at least, all ETFs are an index fund which mirrors an index or a benchmark, unlike actively managed funds whose managers try to beat the market. There have been talk of companies bringing out actively managed ETFs, but so at least in India, it has not been manufactured. Currently, in India, the underlying for ETFs are Index, Sector, Money Market Instruments, Arbitrage etc. One more type to add in the basket of innovated products is actively managed ETF – MOSt Shares M50 ETF, the first of its kind in India, launched by Motilal Oswal Mutual Fund.

Continuous pricing: ETFs are continuously being priced, much like stocks. ETFs is not something you will find too much information on. You might want to check http://babieboomers.com. You can hold it for 5 minutes to 5 months or beyond, the choice is yours. Whereas a mutual fund would take orders during trading hours, but the actual transaction are put through at after the close of the market.

ETFs have long surpassed the assets of separately managed accounts which were up to $527 billion at the end of the third quarter of 2009, according to Cerulli Associates. Commodity funds are another source of which have had aggressive growth. In 1999 separately managed funds grew by $100 million and by the end of 2009 grew by $22.2 billion.

The basic plan: buy one of these ETFs when bullish and the inverse ETF when bearish, or stay out of the market in cash. This strategy is as simple as it can get. Using a timer brings order and safety to the investment because you know whether to buy the bullish ETF or the bearish ETF.

If I am invested in a stock that offers options I can always sell calls on the stock and bring in some premium while the markets are falling. This way I can bring in a monthly income and offset at least some of the loss.

To learn about investing in your 401k click here

9 Reasons ETFs Can Benefit Your Portfolio*

| 1 | Single Transactions—can trade like stock |

| 2 | Liquidity—can sell at anytime |

| 3 | Cost Effectiveness—low fees |

| 4 | ETF Taxes–are tax-friendly |

| 5 | Derivatives—can use options, swaps, and futures |

| 6 | Accountability—their funds are public |

| 7 | Passive Management—adjustments are minor |

| 8 | Simplicity—are simple in nature |

| 9 | Immediate Dividends—like stock; usually quarterly |

The most effective method to Choose The Right ETF

With in excess of 8,000 ETFs to browse, even an accomplished financial specialist could be pardoned for feeling overpowered.

Luckily, a couple of basic advances can limit the decision down to something more reasonable.

The main move

The initial phase in choosing an ETF is to characterize the market section — that is the kind of advantage that you need to purchase. It is conceivable to pick ETFs that focus on resource classes, for example, value, fixed pay and product ETFs and those decisions will as a rule convey various results.

Speculators would then be able to refine their concentration inside every advantage class. For instance, values are frequently separated by topography (locale, nation or stock trade), by market capitalisation (enormous, fair sized or little organizations) or by their monetary division, for example, innovation or vitality.

Speculators may likewise seek after explicit venture subjects, for example, electric vehicles, man-made brainpower or the ascent of millennial shoppers.

Manageable ETFs

Inside a similar market portion, organizations may be separated by their apparent moral accreditations — for instance, “feasible” ETFs may concentrate on explicit topics, for example, organizations with low degrees of water utilization or carbon emanations. On the other hand, reasonable assets may just prohibit protections with undesirable attributes, for example, significant polluters, from more extensive financial exchange benchmarks.

Financial specialists concentrated on such measures should take a look at assets’ venture strategies and portfolios, notwithstanding, as a similar organization can be seen as having a high ecological, social and administration score by one list supplier and a low one by another. Electric vehicle producer Tesla and General Motors, its more customary adversary, are alarming instances of this absence of agreement.

Fixed pay ETFs

Fixed pay ETFs are generally separated by the kind of guarantor (corporate or government), by FICO score (speculation evaluation or high return) or by development date. Speculators can limit the focal point of the introduction despite everything further by thinking about explicit kinds of fundamental protections, for instance convertible securities (where the return will be driven, to some degree, by developments in the organization’s offer cost) or skimming rate securities, which offer financial specialists assurance against rising expansion.

Speculation system

Financial specialists likewise have an ever-broadening exhibit of potential speculation approaches readily available.

ETFs were customarily absolutely uninvolved vehicles, looking to duplicate the arrival of a hidden market list.

Yet, there is currently a little, yet quickly developing, multitude of effectively oversaw supports that look to outflank their benchmark. In the initial five months of the year, more dynamic ETFs than latent ones were propelled in the US, as indicated by information suppliers FactSet and Ultumus.

A different idea, “keen beta”, rides the dynamic and latent speculation draws near. Here a store looks to fabricate a portfolio slanted to at least one “factors” that have generally been related with outperformance, for example, esteem, profit age, force, little size or low unpredictability.

The individual property are, notwithstanding, chosen and weighted by a pre-composed equation, instead of being effectively picked by the store director. As ever with speculation, there is an energetic discussion about the adequacy of shrewd beta methodologies.

Functional contemplations

Contingent upon where it is recorded, an item may essentially be inaccessible to a speculator, or the expense of exchanging the ETF may be extremely high.

Likewise, subsidize chiefs may regularly give various offer classes of in any case indistinguishable ETFs with various profit or coupon strategies. This is a significant factor to consider as it can influence speculators’ drawn out returns altogether.

Gathering share classes reinvest profit and coupon installments, purchasing more stocks and bonds, while appropriating share classes pass these payouts to speculators as an ordinary pay stream. This pay stream is regularly charged at an alternate rate to that of a capital increase.

An ETF’s duty status can likewise be a significant thought in certain nations, for example, the UK.

“Under the UK’s tax collection framework, ETFs domiciled outside the UK are treated as seaward ventures for UK citizens,” said Anaelle Ubaldino, a quantitative monetary counselor at Koris International, a French speculation warning firm connected to TrackInsight, the FT’s accomplice for the ETF Hub.

“Along these lines, all increases, regardless of whether salary or capital, are treated as pay and are liable to burden rates dependent on the financial specialist’s individual profile.”

Notwithstanding, some seaward ETFs have UK Reporting Status and are treated as though they were UK assets for tax collection purposes at the financial specialist level. This permits capital additions from the halfway or all out offer of these assets to be charged at a level capital increases rate. Distinctive expense rules will apply in different nations.

Money hazard

Speculators ought to likewise consider the offer class cash. Holding an offer class named in an unfamiliar cash will normally expose financial specialists to conceivably antagonistic FX moves.

At the end of the day, the cost of the ETF in the speculator’s home money will vacillate with cash moves, conceivably prompting misfortunes random to the arrival of the hidden resources. Albeit a FX gain is similarly likely, this money bungle may infuse some undesirable instability.

ETF guarantors frequently give supported offer classes that empower speculators to fence against this danger. In this situation, the speculation execution will be lined up with that of the hidden resources, yet the expense of the supporting will dynamically diminish returns in the long haul.

The ETF Screener gave by TrackInsight on the FT’s ETF Hub is one device financial specialists can use to help tight down decisions and think about execution of assets.

I have a GREAT Course for you on Creating Retirement Funds with ETFs! CLICK HERE