Common Mistakes People Make In Retirement Planning

Retirement planning is one of those things that tend to get tossed quite often onto the back burner for many couples young and old. Getting finances in order can be a tricky topic to discuss with your significant other especially if it is a touchy subject. There a number of reasons why a person or couple shouldn’t wait any longer to sit down and plan out their strategy in order to retire comfortably.

Social Security – If you think it will be around when you need it, try to take your benefit at normal retirement age, rather than at the earlier age (for example 62). You can even discuss with your financial planner what would happen if you delayed taking it until age 70, where the benefit would be greater.

It’s almost comical where some people will go when they are planning for their retirement. Some actually listen to the advice of friends or co-workers. While this philosophy might have worked back in the days where any stock went up on any given day, today’s investing is far different.

Now that you are aware of it, why not make your dreams come true? To make your dreams come true, you must have a concrete plan. A dream without a plan is just a mere dream. So make your dreams happen!

Planning ahead for any event, as a matter of fact is better than meeting it on the way as sudden as it comes. And for an important event such as retirement, much of planning is needed. Financial planning is the most important thing you can do for yourself when you have the means to do so. It is one of those things you owe yourself. Apart from this reason, there are many other reasons why you might need to be ready with a little extra. For example, times of medical emergencies for you or your spouse. In such events as these the main thing that is wanted is money and if you have not saved for it, life may not be easy.

Studies show that there are 60 million working women out there and a little less than half are enrolled in a retirement plan. It will be hard to have a retirement fund if there are no contributions to it.

You may want to seek help from a professional that can give you good advice about your Retirement planning. There are many companies that are going to offer assistance for a small fee and they will point you in the right direction. If you are browsing websites for Retirement planning you will find hundreds among which is http://babieboomers.com. If you are working and have a good benefit package through your employer, you may already be able to have some type of retirement plan set up through them. This is going to be worth checking into so that you are able to be comfortable for retirement.

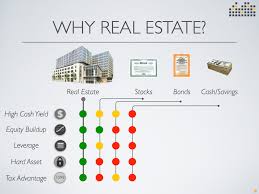

Now, once you know this, figure of the amount of money you’ll need to achieve that. At this point, you simply need to find the right investment investments for you. Keep in mind, most people choose a mutual fund, or some such investment in order to achieve the retirement goals. However, you can never make up as much money relying on others to do your investing for you as you could doing it for yourself.

It is important to know what your income will look like at retirement age. What will your social security benefits look like? At what age do you intend to retire? Will your home/auto/boat be paid for?

Women retirement planning is going to be the same as anyone else. You should seek help from a financial planner so that you are ready and able to retire when the time comes. These organizations will help you figure out what you are going to need to have for retirement and how to invest the money properly so that you are secure. You will want to think about looking at a retirement planning guide so that you are able to get ready on your own and have the right knowledge for everything that you will have to have so that you can retire in comfort.

Read up on all the information that you can as well. There are plenty of articles and topics on this subject. You will want to find out all that you can so that you are prepared to make all the final choices for your retirement planning. There is advice that you should take so that you are able to make the right choices and you will want to be sure that you do what you feel is going to be the best plan of action for your needs.

To learn more about successful investing, click here.

The 23 Big Retirement Mistakes that Most People Make*

| 1 | You Don’t Know What You Spend Money On |

| 2 | You Own Too Much House |

| 3 | You Don’t Have an Investment Policy Statement |

| 4 | You Don’t Know About Personal Finance |

| 5 | You Aren’t Saving Enough |

| 6 | Not Having a Plan for Turning Savings to Income |

| 7 | You Own Too Much Stuff |

| 9 | You Are Paying for Storage |

| 10 | You Are Paying for College |

| 12 | Spending Too Much for Care for Aging Parents |

| 13 | Taking Social Security Too Early |

| 14 | You Have Too Much Debt |

| 15 | You Hold Too Much Cash |

| 16 | You Don’t Have an Emergency Plan |

| 17 | Not Planning for Medical Costs |

| 18 | Not Having a Long Term Care Plan |

| 19 | You Don’t Think About Retirement Taxes |

| 20 | You Are Stuck in a Rut |

| 21 | What You Are Going to Do in Retirement |

| 22 | Underestimating Your Life Expectancy |

| 23 | You Don’t Have a Written Retirement Plan |

5 Steps To A Great Retirement Plan

Shocking as it might appear, the greater part of Americans (56%) don’t have the foggiest idea how much cash they’ll have to resign. Exploration distributed by Schwab Retirement Planning Services found that by and large, people with 401(k)s accepted they required $1.7 million in the bank to resign serenely, yet extremely few were on target to arrive. Encountering an agreeable retirement is an all around wanted objective, yet it’s undeniably hard to track down clear direction on the most proficient method to accomplish this objective. Absence of lucidity around how budgetary choices and propensities can direct retirement arranging drove Zoe Financial to go over piles of scholarly papers, government segment examines, institutional examination, and that’s just the beginning. Zoe Financial’s recently delivered retirement arranging guide, The Road to Retirement, sets up a solitary wellspring of truth on making arrangements for retirement by illustrating five key stages in the retirement arranging measure.

Making arrangements for Retirement Isn’t One Size Fits All

Making arrangements for retirement isn’t “one-size fits all.” That is the reason Zoe’s Guide to Retirement Planning approaches arranging through a comprehensive system that assesses how a person’s feelings, qualities, and funds cover.

The Road to Retirement permits the peruser to follow their own retirement arranging venture close by unmistakable periods of their life, with the end goal that they can distinguish, assess, and actualize the procedures that best fit their individual budgetary objectives.

The Five Phases of Retirement Planning

- Acquire More to Save More

Retirement arranging is regularly fixated on the standard of “spend less, spare more,” yet this exhortation frequently misses the mark when retirement feels far off. The Earn Phase talks about the benefit of augmenting a person’s winning potential. The Earn Phase is generally suitable for people who are just barely now setting off on their experience into planning for retirement and need to figure out how to win more, to spare more.

- Save for Retirement

When an individual has boosted their procuring potential, they can start the Save Phase. From finding what sort of saver they may be to how the best systems for moving toward building retirement investment funds, the Save stage empowers perusers to guarantee they are moving toward sparing towards retirement adequately. Moreover, it talks about how to choose the correct retirement investment account (Employer-Sponsored Retirement Plan, for example, a 401k or 403b or an Individual Retirement Account IRA), all while watching out for way of life creep.

- Develop Your Nest Egg and Investment Portfolio for Retirement

When month to month reserve funds commitments don’t make a generous scratch in one’s savings, it’s basic that the individual start thinking about how to develop their portfolio.

From the start, it’s unmistakable development is driven by commitments, however over the long haul, the record esteem is overwhelmingly determined by the exacerbating of one’s speculations. For people keen on figuring out how to contribute more brilliant, the Growth Phase centers around how to develop one’s riches by permitting exacerbating to do the truly difficult work. Moreover, the stage jumps further into how to comprehend resource designation, hazard limit and danger resilience, charge suggestions. At last, the Growth Phase surveys how to know about likely hidden expenses in a speculation portfolio.

- Progress into Retirement

Customary retirement arranging frequently does exclude a Transition Phase. Lamentably, neglecting to anticipate one’s progress into retirement can make a genuine adverse scratch on an individual’s retirement. Progressing into retirement is the most inalienably remarkable as it will rely upon existing reserve funds and speculations, wellbeing conditions, salary, and a large number of different elements. A guardian monetary consultant can be useful during this stage, as they help their customers keep away from arrangement of return hazard and other expensive slip-ups that regularly happen while staging into retirement.

- Safeguard and Enjoy Your Wealth in Retirement

So as to easily appreciate retirement without agonizing over one’s accounts, it is essential to actualize procedures that guarantee a steady retirement salary. The last stage, Preserve and Enjoy, trains how to build up a reasonable retirement pay plan through structures including the Buckets System, Target Risk Portfolios, and Target-Date Funds. Similarly significant is understanding required least dispersions (RMDs) and how much/from which accounts an individual ought to pull back from to live off without being worried about outlasting their cash or depending completely on government managed retirement or benefits.

I have a GREAT Course for you on Retirement Planning! CLICK HERE