Ten Outrageous Ideas To Organize Your Finances

Acquiring money isn’t always about the ‘time in exchange for paycheck’ routine. How much wealth you acquire is also affected by other elements such as your thoughts and beliefs.

What you need to do is to set up a payments and records tracking system. You can track which of your bills are paid automatically and by what payment source. You will also what to organize your other financial records.

Really think about the paperwork you are collecting. Is it required for proof of something? Is there any reason at all that you would need it in the future?

Organize Finances…. your files — Start a paper filing system. Sure, you may find way more Organize Finances information than http://babieboomers.com and I encourage you to search. Get manila folders to organize statements, bills, letters, and other important papers. If it’s important it should have a place to go.

Avoid borrowing money or getting a credit card. Although having one credit card is important for emergency purposes, you should never put yourself in a bad situation with too much credit because that can easily leads to trouble in the future. People usually have to take out a loan for a car or a house.

Once you have sorted through all of your mail and thrown out all of the junk, place the bills in a “bill folder” or a tray on your desk so that they are all in one place. A dedicated location to just hold all of the bills. Some office supply stores sell a notebook sized binder that contains 12 pockets, one for each month. These work great. You place all of your bills in the current month’s pocket. Then when you are ready to pay the bills you go to that pocket. All of your bills are right there in one place making it convenient and easy to manage. Another way to organize is to purchase a filing box for hanging files and place all of your bills either in individual folders or again use 12 hanging files, one for each month like the notebook above.

Many people have their finances organized and planned right down to the cent and you are probably like most. But even organized people need a system to help manage and organize their bills so they don’t lose them, forget to pay them, and therefore have the electricity shut off.

No matter what your situation no one is properly organized. It’s really a shame because taking the time to do it just once can be a life-changing experience!

If you have excess cash and are just itching to use it, you should consider purchasing a new computer or electronic data processing system. Since this is 100% deductible to the end of February, 2011 it can greatly reduce your taxes payable.

Every debt consolidation company offers something a little bit different, so keep that in mind as you choose the right one. Most of the good ones are willing to work with you to individualize your plan, though. Depending upon how much you are able and how much you are willing to dedicate to paying off the debt, you will have different payment requirements from someone else. Whether you want to go at it full speed or you’re looking to take it slow, having an organized approach can pay dividends.

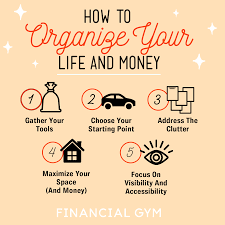

10 STEPS TO AN ORGANIZED FINANCIAL LIFE*

| 1 | Organize Your Snail Mail |

| 2 | Organize Your Inbox |

| 3 | Organize Your Important Documents |

| 4 | Create a Joint Account with Your Spouse |

| 5 | Use a Budget as a Tool |

| 6 | Start Tracking Expenses |

| 7 | Negotiate Your Way to Lower Expenses |

| 8 | Know Your Exact Amount of Debt |

| 9 | Determine if Refinancing Your Loans is the Right Option |

| 10 | Schedule Periodic Checkups for Accounts |

*Source: Financialresidency.com

5 Crucial Planning Steps To Take Before You Retire

There will in general be a ton of energy noticeable all around as one methodologies retirement. Mulling over how to burn through one’s brilliant years speaks to the climax of many years of difficult work and the capacity to appreciate the one’s rewards for so much hard work. While the excitement is justified, it’s likewise pivotal to settle on some significant monetary arranging choices before the great starts. A significant number of these choices are awkward as they include changing parts of one’s life that may have been consistent for quite a long time or confronting the dismal outcome of one’s decay in wellbeing or downfall.

It’s basic to confront the disagreeableness, as ignoring these basic zones may prompt difficulty later on. The following is a rundown of a few arranging steps to take with your friends and family and expert consultants so as to lay the basis for a less upsetting and a lot more extravagant retirement.

- Cut back your home size: A home, in contrast to a stock or common reserve, is a passionate resource. Individuals become connected to a home as it is the setting for, and related with, a portion of life’s fondest recollections. The idea of selling your home can feel pulverizing, yet it quite often bodes well. Staying in a bigger home than should be expected presents an assortment of difficulties as one gets more seasoned.

One such test is the money related weight. Most retirees are on a fixed financial plan, with no income development and restricted capacity to expand income. Possessing a bigger home requires various monetary uses, including higher property charges, protection inclusion, upkeep expenses, and then some. There is additionally the psychological pressure related with the upkeep of your home. Would you truly like to spend your retirement stressing over a cracked rooftop, broken latrine, or harmed sewer line? The psychological weariness that originates from fixing and keeping up your home ought to be assessed to decide whether the pressure merits the advantages. At long last, the capacity to move around your home may likewise end up being a worry sooner or later. For instance, on the off chance that you purchased your home decades sooner, you presumably didn’t mull over having your room higher up. As people age and medical problems become more predominant, the capacity to easily explore your home ought to be a need. A huge roomy home, with various levels, is commonly not handy for seniors.

Movement is another significant thought identified with scaling back. This direction for living isn’t just money related. While one may have a tightknit gathering of companions in their present network, numerous retirees choose to draw nearer to family to guarantee that they have a dependable encouraging group of people as they age. It’s far superior to be proactive, as opposed to responsive, about migrating. It isn’t charming, or reasonable, to watch your counterparts move away while you’re left in an entirely different network than where you spent the most recent couple of decades.

Pragmatic answers for lodging for retirees should concentrate on another arrangement of needs. These incorporate money related cost, security, psychological wellness, physical restrictions, and being around individuals on whom you can depend. A high rise or retirement network that is close to family might be acceptable alternatives for some. The sooner you settle on the choice to scale back, the more difficulty you can spare yourself not far off.

- Smooth out your ventures: Determining a legitimate resource designation, a proper withdrawal methodology, and planning different pay streams are immensely significant strides to have an agreeable retirement. Nonetheless, before any of these means can be taken, speculators need to sort out their benefits.

Throughout one’s vocation, it’s very normal for individuals to open records at different budgetary establishments. This by and large beginnings with only a checking and investment fund, and afterward a 401(k) through their manager. After some time, people start to aggregate more records, including a combination of old 401(k)s, exchanging, investment funds, and trust accounts. Overseeing and following every one of these records can get lumbering. One old couple that was alluded to me numerous years back had 22 records at 17 unique establishments in addition to singular stock authentications. Their lawyer requested that I assist them with combining their benefits so as to appropriately draft their home arrangement.

There is seldom a legitimate motivation to have one’s advantages spread around at so various foundations. Prior to retirement, it benefits everybody to unite accounts, where suitable. This cycle will rearrange your life, keep your funds more sorted out, and make it more consistent for your friends and family to help you when the opportunity arrives.

- Keep your home arrangement updated: It’s consistently critical to have a refreshed bequest plan. This is significantly more fundamental as you get more seasoned, collect more riches, and need to get ready for the progress of that cash to the people to come. The principle records for a legitimate domain plan incorporate a will, intensity of lawyer for accounts, intensity of lawyer for wellbeing, and a social insurance mandate. This kind of arranging is something that isn’t possible without appropriate preparing and experience. Investing the energy and cash for an able bequest arranging lawyer, rather than a generalist or online stage, should pay off later on.

It’s additionally imperative to survey recipients on your retirement records and protection arrangements to guarantee that they are right. The exact opposite thing anybody needs is to work their whole vocation and have the greater part of their riches be acquired by an ex-companion or dead family member. Investigating one’s recipient assignments on the previously mentioned things is a basic method to forestall such stumbles.

Another significant segment of home arranging is encouraging correspondence between one’s home lawyer, bookkeeper, and monetary counsel. This guarantees all consultants are on the same wavelength to appropriately actualize any trusts or other home arranging reports and execute the finished bequest plans. It is useless to contribute time and assets to assemble a bequest plan in the event that it were not decisively appropriately executed.

- Plan for long term care: According to LongTermCare.Gov, somebody turning 65 today has a 70% possibility of requiring some kind of long term care administrations in the course of their life. The requirement for long term care is characterized as not having the option to perform errands of every day living because of inability or interminable disease. The undertakings of every day living are eating, washing, getting dressed, toileting, moving, and moderation. As individuals keep on living longer, the requirement for this consideration will be a reality for some. Inability to anticipate that chance can be monetarily and sincerely obliterating for one’s whole family.

The first, and generally significant, thing to comprehend about long term care arranging is that it is not the same as customary home arranging. The way that you have your will or Power of Attorney won’t really be useful for a constant disease requiring long term care. You might need to recruit a lawyer that spends significant time here to design appropriately.

Long term care arranging for the most part falls into three methodologies: Self store, purchase protection, or Medicaid arranging. These procedures are not fundamentally unrelated. Contingent upon your particular circumstance, one or these things may play into how to structure your arrangement. It’s critical to perceive that the expenses of care can be cosmic. As indicated by LongTermCare.Gov, the public normal for a private room at a nursing home is $7,698 every month. The number can fluctuate contingent upon where you live. For instance, as indicated by information by Genworth, the expense would be around $13,000 in the metro New York City district and roughly $6,000 in Jackson, Mississippi. Accordingly, self-subsidizing or having protection may not get the job done. There is no deficiency of repulsiveness tales about people who pushed off arranging until it was past the point of no return and became devastated or burdened their friends and family with a burdensome duty.

- Decide how to invest your energy: While money related arranging is basic, there is another similarly significant viewpoint to retirement arranging. As I tell my customers, it’s critical to resign to something and not from something. It’s amazing what a limited number of individuals have a reasonable methodology for how they will invest their energy in retirement. You dislike your chief or day by day drive, yet resigning to dispose of those irritations isn’t a formula for satisfaction. The dismal truth is that most diversions, for example, golf and traveling, by and large aren’t adequate to possess the entirety of one’s time and will leave retirees exhausted and unfulfilled.

A more practical perspective on retirement might be to work low maintenance, volunteer, and to have routinely planned encounters with loved ones. A blend of these exercises can help give every day structure, social collaboration, and scholarly incitement, all basic components for fighting off fast physical and mental decay. It’s basic for those approaching the finish of their vocation to have an all around characterized and handy arrangement for how they will go through their days in retirement.

Lingering is the significant hindrance with regards to these significant retirement arranging steps. All things considered, it’s a lot simpler to leave these choices as a second thought than make them today. In any case, delaying will just prompt more difficulties after some time. As the maxim goes, “inability to design is wanting to fall flat.” to serve your friends and family, disappointment ought not be a choice.

Use QuickBooks to organize your finances.

I have a GREAT series of videos for you on Financial Organization! CLICK HERE