Here’s What No One Tells You About Passive Income

First, passive income, also known as residual income, is defined as income that is made from prior effort that takes little or nothing to maintain. Doesn’t that sound more appealing than punching a clock? You see, most people trade hours for dollars. If you put eight hours into a job you get paid once for those eight hours. In order to get paid again you have to put in more time. That is the reason why the word job has been turned into the acronym J.O.B. that stands for Just Over Broke.

One of the ideas that make residual income so powerful is that residual income is not directly proportional to the number of hours invested or number of products/services sold. It is Passive income ideas that continues to be generated after the initial effort has been expended. With residual income, 40 hours of work can garner much, much more than 40 hours of pay.

And maybe we are somewhat, but considering all this it seems to me that there is really only one way to build true passive income, and that is to allow someone else to do it for you. And this is a really tough one, since who wants to work so you can earn?

A stream can be much smaller and as long as it is leading to the same lake, you will be able to generate a large income as a variety of streams work hard to fill this lake. If for example, your goal was to make $50,000. a month – it might be easier for you to create 5 income streams at $10,000. a month as opposed to one river earning you a total of $50,000. Multiple streams of income are a great way to work your way to wealth.

Other people are already doing it. Sure, you may find way more Passive Income information than http:/babieboomers.com and I encourage you to search. When others knock Passive Income ideas and tell you that you can never make one work do they really expect you to believe that there is no one in the world already doing this? Just because you don’t know anyone who tells you that they do this work doesn’t mean that they don’t exist. I don’t personally know any firemen, librarians or astronauts but I don’t doubt their existence. There is no doubt that earning money online is something which many, many people are already doing, and the following points will help us understand how.

Most people invest in stocks for their retirement. This is probably because it is the easiest way to invest. But that doesn’t mean it is the best way to invest. Sometimes the returns on stocks are so poor you need millions before you can generate enough passive income to retire. The stock market is also volatile and you can lose a lot of money very quickly in a stock market crash.

Imagine putting in about a week’s worth of time up front and then an hour or so every other week, but still making a decent amount of money. In fact if you want to do it all yourself all you will need is the cost of a domain name and the price of hosting. If you want to outsource, you will need the added cost of paying the person doing the work for you. Either way your initial outlay is really very minimal.

Royalties from publishing a book, singing a song, being involved in a movie or from licensing a patent or other form of intellectual property How to get it: Write a book and get it published. Get a song on the radio. Produce or act in a movie/T.V. show/commercial. Invent some cool gadget. Make a neat software program. There are other steps, but I’m guessing if people were doing these, they would not be reading this article.

It seems to me that most of these opportunities simply have the outward appearance of being passive, when really they are not and essentially only turn out to be ways to keep us busy while believing that we are building passive income.

Personally I see it as a system you set up over a number of years and then hopefully it will grow itself, generating enough income for you to live off. One of my favorite passive income sources is through Dividends.

28 Best Passive Income Ideas To Earn $1k+ a Month*

| 1 | Invest in (crowdfunded) real estate |

| 2 | Save with a High Yield Savings Account |

| 3 | Save with Certificates of Deposit |

| 4 | Invest in Stocks/bonds/REITs |

| 5 | Invest in Dividend Growth Stocks |

| 6 | Invest in a rental property (or two) |

| 7 | Invest in Worthy Bonds |

| 8 | Write an e-book |

| 9 | Create an online course |

| 10 | Get paid to do things you’re already doing |

| 11 | Promote products and earn affiliate income |

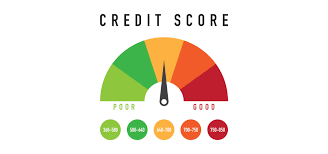

| 12 | Take advantage of credit card sign-up bonuses |

| 13 | Take advantage of bank account promotions |

| 14 | Advertise on your blog |

| 15 | Rent out extra space in your house |

| 16 | Rent out items you already have |

| 17 | Become a peer to peer lender |

| 18 | Become a private lender |

| 19 | Flip domain names |

| 20 | Become a social media influencer |

| 21 | Buy a laundromat/car wash |

| 22 | Rent out ad space on your car |

| 23 | Invest in a local business |

| 24 | Start a Vending Machine Business |

| 25 | Invest in Royalty income |

| 26 | Sell pre-packaged stock photography |

| 27 | Build an app |

| 28 | Design products to sell on CafePress or Redbubble |

*Source: Wallethacks.com

7 Rules For Using Real Estate Investments For Passive Income

Here’s the way to utilize detached land putting resources into your portfolio.

Putting resources into land can be a keen move in case you’re keen on making new salary streams. “Land can be an extraordinary method to produce automated revenue that is not subject to your chief business,” says Rick Myers, organizer and leader of Integrated Financial Services in Grand Rapids, Michigan. As a landowner, you can receive the double rewards of thankfulness from your venture and continuous rental salary. That can assist with guaranteeing a more agreeable retirement or help to keep you above water if a monetary slump brings about the loss of your essential activity. In case you’re keen on utilizing uninvolved land putting procedures in your portfolio, here are seven standards to follow.

Pick your strategy.

Putting resources into land for easy revenue isn’t one-size-fits-all. Before swimming in, first make sense of what system fits best, says Colton Brausen, business intermediary for Kris Lindahl Real Estate in Minneapolis. For instance, consider whether you’re more keen on possessing a high rise or multifamily home to create land automated revenue versus a business working in which you’re managing business occupants. Additionally consider how included you need to be with regards to things like gathering rent or taking care of fixes, and whether you’d want to hand off those obligations to a property the executives organization. “There is no correct answer,” Brausen says. “It relies upon you as the financial specialist and where your solace lies.”

Latency doesn’t mean uninvolved.

Producing land salary inactively can assist you with bringing in cash in your rest, however it requires placing in some time and money in advance to get that pay streaming. “Such a large number of individuals are detached about the venture choices themselves, and that can prompt dynamic cerebral pains,” says Adam Kaufman, fellow benefactor and head working official of ArborCrowd, a land speculation firm. While there are a lot of chances to make automated revenue, investment property speculators can’t avoid due tirelessness. Kaufman says financial specialists ought to be proactive in altogether investigating speculation properties. That implies posing inquiries about the property and the dealer before focusing on the buy. Furthermore, if the appropriate responses you get leave you with significantly more inquiries, you ought to presumably proceed onward, he says.

Enhancement matters as much as area.

When utilizing land for easy revenue, it’s critical to think about the degree of broadening in your portfolio. “Putting resources into a portfolio that is expanded by property type, occupant blend and geology will significantly build the likelihood that it will give a steady and unsurprising stream of salary over the long haul,” says Scott Bennett, a land guide with Wells Fargo Private Bank. Contingent upon the amount you have accessible to put resources into latent land, that may mean possessing various investment properties. Or then again you could decide to spread your speculation dollars across various land shared assets, land venture trusts or crowdfunded investment properties. Broadening land salary streams is vital to adjusting danger and prize.

Focus on land market patterns.

Certain portions of the land market may perform superior to others during times of market instability or more extensive monetary shifts, for example, a downturn. For example, Jeff Holzmann, CEO of IIRR Management Services, focuses to the multifamily segment as possibly being stronger than business properties, for example, lodgings or places of business during testing financial situations. While multifamily lodging isn’t totally hazard free, it might offer better open doors for returns if interest for private rental units stays high. Figuring out how different pieces of the land market respond to changing monetary conditions can assist you with finding the best chances to keep latent land salary coming in reliably when the nation is encountering a decline.

Pick the correct capital sources.

When purchasing land for automated revenue, applying for a new line of credit is an undeniable decision – however don’t disregard the advantages of utilizing retirement resources for make rental salary. “A self-guided IRA offers you the chance to settle on venture choices in regions dependent on your insight and mastery,” says Kelli Click, leader of Strata Trust. You can utilize a self-guided individual retirement record to buy private investment properties, business rentals or even land to create automated revenue. Utilizing IRA resources can assist you with abstaining from assuming obligation and having interest installments on an advance cheapen your profits. There are sure IRS rules you have to follow when taking this course, so Click proposes bringing an outsider property administrator on board to abstain from violating.

Know your time skyline.

Uninvolved land putting is something you could remember for your portfolio for a considerable length of time to come, however it’s critical to know your time skyline when choosing which properties to put resources into. “Great land is more illiquid in nature and intended as long as possible,” says Peter Brunton, boss venture official at Strategic Wealth Partners. That implies in the event that you envision requiring the money you’re wanting to put resources into an investment property in the following five to 10 years, you’ll have to contemplate how simple it will be to inevitably offload that benefit. Once more, that returns to performing due steadiness and considering market drifts so you have a thought of what interest for the property will resemble down the line.

Proficient assistance can make inactive land contributing simpler.

Regardless of whether you’re putting resources into land for automated revenue just because or you have quite a long while of experience possessing investment properties, think about bringing in the experts for help. That begins with interfacing with an accomplished operator who can walk you through the advantages and disadvantages of different speculation alternatives, Brausen says. When you locate an investment property for easy revenue, your group may extend to incorporate a property chief, land lawyer and temporary workers to get the property fit as a fiddle or keep it kept up. A portion of your benefits will go toward paying them, yet it tends to be well justified, despite all the trouble in case you’re ready to create land salary without doing any hard work yourself.

Seven principles for utilizing land ventures for automated revenue:

- Pick your strategy.

- Passive doesn’t mean uninvolved.

- Diversification matters as much as area.

- Pay regard for land market patterns.

- Choose the correct capital sources.

- Know your timeline.

- Professional assistance can make uninvolved land contributing simpler.

I have a Great Course for you on Passive Income! CLICK HERE