Everything You Need To Know About Personal Budget

Probably the hardest word to say is the “B” word: Budgeting. Everybody needs a spending plan. The issue is the manner by which best to make and live inside a financial plan without contrarily affecting your everyday life.

While this theme will the least engaging it is seemingly the most significant. I never like sitting down with somebody for an hour and eliminating fun costs. In any case, it is a significant segment of your monetary objectives.

There is no size-fits-all answer. I have seen a wide range of sorts of spending plans and following instruments that have worked for individuals throughout the long term. The most appropriate answer is utilizing a framework that works for you. That is a cop-out answer, yet it’s actual.

Evaluate a couple of various strategies and see what works best. Some are:  Online apparatuses and number crunchers, for example, Mint.Com and Kiplinger’s Household Budget Worksheet.

Online apparatuses and number crunchers, for example, Mint.Com and Kiplinger’s Household Budget Worksheet.

Applications, going from Quickbooks to some that even transform planning into a game (YNAB – You Need a Budget).

Books. For the individuals who have minimal expenditure spared, Dave Ramsey’s Complete Guide to Money is an incredible beginning to your planning objectives. For the individuals who are now on their way, my book Decades and Decisions: Financial Planning At Any Age will prove to be useful.

Indeed, even a “Spending Cleanse.” One account blogger went a year without going through cash, aside from lease, medicinal services and fundamental food. While he said it changed the manner in which he took a look at spending, it doesn’t sound fun (or doable) to me. Yet, that is simply me.

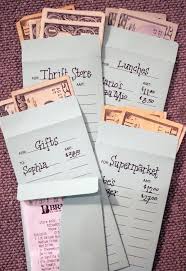

At last, there are two old fashioned spending techniques consistently worth considering: the envelope strategy and spreadsheets.

Planning’s Old Faithful: The Envelope Method

Clients of the envelope framework put cash into envelopes for each going through classification consistently. When they go through all the cash in the “Shopping” or “Eating Out” envelope, they need to hold up until the following month to go through extra cash.

One of my customers follows this strategy week by week and has had accomplishment with adhering to her spending plan. She’ll go to the bank and pull back a specific measure of cash every week that will be her reserves for her week by week spending. This thus hinders my customer from going through more cash by utilizing a check card. By having cash in your wallet, you’re ready to monitor what you’ve spent. When your cash begins diminishing in your pocket, you’ll start to address whether the thing in your grasp merits purchasing.

A Workhorse that Works: A Simple Spreadsheet

I as of late knew about a thought for beginning a spending plan from a more youthful couple. Their checks were kept electronically like clockwork. To follow their spending on a check to-check premise, they made a basic spreadsheet. The spreadsheet began with their net check (what really goes into their financial balance). For the following fourteen days, they added to the spreadsheet each cost they really caused, and the spreadsheet diminished the check absolute each time.

This simple exercise is totally custom-made to the individual making it. It very well may be troublesome if the majority of your costs are to start with or month’s end. On the off chance that that is the situation, track your costs consistently.

This methodology might be more work escalated than utilizing internet. That could be something worth being thankful for however, on the grounds that a greater effect happens when you physically write in each cost, instead of having a program catch it for you. The composing fills in as a genuine token of the amount you are really spending, including the costs you regularly don’t consider. Things like home fixes — state, a messed up dishwasher — can truly include.

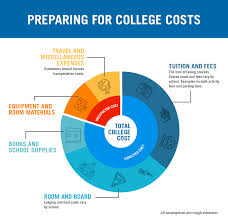

Beside those surprising costs, you may have youngsters on a school or neighborhood sports group. Continuously remember the startling expenses of movement to and from games just as the chance of remaining in a motel for the farther voyaged occasions. Different costs you need to consider are food, outfits, shoe wear, and even athletic gear. These truly factor into how you’re going to spending plan.

As you make sense of which technique is best for you, regardless of whether it’s a worksheet, application, the spreadsheet strategy or the envelope technique, remember that none of these procedures may suit you impeccably. You may very well concocted your own one of a kind technique en route. Continuously remember the repetitive charges every month. That will assist you with figuring out which strategy will be simpler to work with as you financial plan.

Whatever course you take, the objective is to keep up a sound spending that will satisfy all your budgetary needs — from this point until retirement.

Many people view personal budget planning in a negative light. They see it either as a desperate attempt to get out of debt, or as a set of handcuffs to prevent them from having the things that they really want. In this view, following a budget is only a necessary evil. However, it may be more helpful to focus on the long-term benefits that can come from the traditional budgeting process, such as peace of mind and ultimately, financial freedom.

Second, take a full month and keep all your receipts. Go through them and see exactly what you spent and what you spent it on. This will help give you a good idea of what you need to budget for. Some of us think we only spend $100 a week on groceries, when it is really closer to $150 or maybe that is the case with gas for your car.

With some simple personal budgeting you will be able to save some money to pay off your bills — you can be on your way to being financially stable. The best thing to do for your budget is to sit down and make a list of all your expenses. Keep up with yours to get things back under control.

Here are 12 Steps to Make a Budget*

| 1 | Decide to Start a Budget |

| 2 | Know How Much You Have |

| 3 | Figure Out How Much You Make |

| 4 | Know What You Owe |

| 5 | Determine Your Net Worth |

| 6 | Know Recurring Monthly Expenses |

| 7 | Enter This Information into a Database |

| 8 | Look at the Bottom Line |

| 9 | Make Adjustments Accordingly |

| 10 | Adjust as Needed |

| 11 | Pay Yourself First |

| 12 | Track, Monitor, and Be Disciplined |

*source: moneycrashers.com

Free software often comes with a catch. In some way it’s limited or requires extra work from you or worse. There may be little or no support which may leave you stranded at some point and unable to use the system and maybe unable to get to your information.

And that’s precisely the point; the vast majority of people in the United States are failing financially. If you are one of them and you want to do something about it you need to create a Personal budget. By not controlling your money you lose the opportunity make your money work for you. If you are browsing websites for Personal budget you will find hundreds among which is http://babieboomers.com. Those who have built personal wealth have done so by telling their money what to do, not because they have high paying jobs or inherited it. And they do this by creating a budget, or cash flow plan, that tracks every dollar that comes in and every dollar that goes out.

Here’s what a personal household budget does for you. It allows you to track your income and expenses and shows you where your expenses are more then they need be. This allows you to make informed decisions about how you spend your money and what you need to do to ensure that your future is financially sound.

Remember to take into account things you pay for once a year. They will not show up on your bank account until they are due. Things like insurance premium, car registration, membership dues, etc. need to be divided by 12 and allocated to your monthly budget.

You could then take your week’s worth of notes and make a monthly budget. But, to make your budget even simpler, do a separate budget for every pay check, or make a separate column on your spreadsheet for every paycheck. That means if you get paid every week, have a column for every week.

Second, reward yourself for following your budget. You can use your clothing or beer as a reward. Maybe each week or month, when you have followed your budget completely you can reward yourself by allowing yourself to spend money on something you enjoy. Make sure this is figured into your budget though.

For instance, if you’re currently working full-time for minimum wage in Ontario, that’s $10.20 X 40hrs/week = roughly $20,000/year. If you’ve been working for the last 5 years, you’ve made about $100,000. Where is all that money? Can you account for it? Not having a budget is a recipe for disaster.

It’s all about priorities. At first it may seem that there’s no money available in your budget to take a night class or visit a friend, but once you identify what’s important to you, with a few changes you’ll soon see that a personal budget can create the lifestyle you want. Even on limited funds.

How to teach our children about budgeting?

There’s a ton of vulnerability noticeable all around as we enter the current year’s “class kickoff” season. Regardless of whether guardians are starting their youngsters into the universe of covers and socially separated at-school learning or encouraging at-home learning, many are leaving on an unknown area.

The purpose of this activity is to inspect the planning cycle, planning passages, information assortment, investigation and following. Alright, not so much – the fact of the matter isn’t to lecture your children; the objective is to show them the significance of putting a spending plan enthusiastically.

You can utilize an outing to the supermarket or store – everybody adores field trips – as the exercise’s highlight. Before you venture out from home, start with a conversation of how much cash your family goes through on goods every month, just as the sum you’ve saved for the up and coming outing. Make a supper plan and a going with shopping rundown, and work with your kid to gauge how much every thing will cost. I wager this will be an illuminating movement; most children, including our own as they were growing up, have no clue about how much goods cost.

With your rundown and financial plan close by, it’s an ideal opportunity to hit the staple walkways. As you examination shop, feature the estimation of store brands. Also, when you run over enticements that aren’t on your rundown, help your youngster to remember the significance of adhering to a spending plan.

Similarly as with all learning works out, remember the after-activity survey. Together, all out the things you jumped to show your understudy how little buys can include. This is your opportunity to interface the idea of planning to your youngster’s regular day to day existence. The $12 you spared by fighting the temptations can go far toward a sweet treat or a pleasant family action.

Whenever you head to the store, placed the children responsible for part of the rundown. In the event that they can finagle some astute reserve funds, let them receive the benefit.

After several outings, your child ought to comprehend that the merchandise and enterprises we devour accompany a sticker price; they’ll see how planning works; and they’ll have a superior thought of requirements versus needs. In particular, you’ll have planted the seeds for a daily existence lived inside methods.

See this for budgeting tips

I have a GREAT video series for you on Budgeting! CLICK HERE