Budgeting for Beginners

High workers are copious in the United States. Indeed, 29% of families make over $100,000 or more every year. As a high-worker, planning is especially significant. However as a rule, the focal point of a financial plan will in general be on systems for spending less. Rather, the reason for a financial plan for high workers is to guarantee you’re adjusting your spending to your qualities and long haul objectives. These five stages for making a family spending plan can assist you with delving further into ways your way of life may be contrarily influencing your future objectives and whether your cash choices coordinate your qualities.

Stage 1: Evaluate Your Income

While it might sound insane, it’s very normal for individuals not to realize precisely how much pay is coming their direction month to month. Assembling the entirety of your pay will give a thought of how much cash is coming in and will give you a more clear attention to your riches. While recognizing your month to month salary, recollect that your financial plan ought to be founded on your net gain, which means the measure of cash coming in. To figure this, you have to take away your derivations: charges, Social Security and medical coverage.

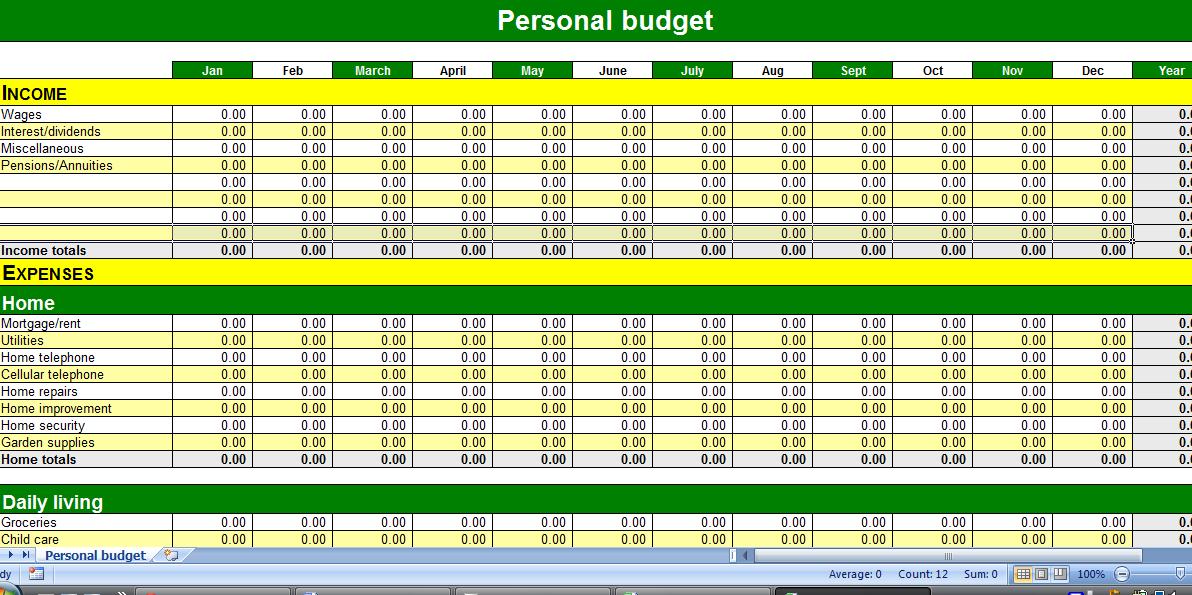

Stage 2: Create A List Of Monthly Expenses And Evaluate Lifestyle Creep

When you have determined your net pay, the subsequent stage is to make a rundown of your month to month costs. The most ideal approach to distinguish your month to month costs is to rundown and total up the entirety of your costs. Start by organizing your costs by fixed fundamental costs, (for example, contract/lease and property tax) and variable basic costs (food supplies, gas, utilities), trailed by other costs (eating out, amusement, leisure activities). What’s the blend between necessities (your electric bill) versus “needs” (moving up to a Tesla X)? For exactly, a high salary can prompt “way of life creep.” As you procure more, your costs “creep up,” which can at last wind up discouraging you from accomplishing huge picture money related objectives.

Stage 3: Analyze Whether Your Spending Matches Your Values

We as a whole have intrinsically extraordinary perspectives about cash and life ways, yet an excessive number of individuals wind up imitating the manner in which others handle their money. The initial step to assessing whether you’re coincidentally going through your cash in a manner that doesn’t coordinate your objectives is to make sense of what precisely you esteem. At the point when your qualities aren’t lined up with your budgetary propensities, you won’t feel like you’re really ready to accomplish your objectives.

Start by assessing what is important to you in your connections, vocation, wellbeing and other worldliness. Record your qualities for every classification as you remember them, posting them from generally imperative to least. This will empower you to assess whether your life is as of now in accordance with your qualities. For instance, when I was 31 and chipping away at Wall Street, I was working each weekend. One of my most significant qualities was being with my family, yet my time wasn’t lined up with what I esteemed most. The second I re-aligned my time with my qualities and changed to a job where I could invest more energy at home, my life quickly improved.

Essentially, your qualities must match your ways of managing money to accomplish your budgetary objectives. Are your qualities reflected in the manner you spend? Contrast your month to month costs and your enormous picture monetary destinations. For instance, on the off chance that you esteem your child’s instruction yet are spending a bigger lump of your salary on that updated SUV than on their 529 college, this is an extraordinary chance to straighten out your ways of managing money to coordinate your qualities. Recollect that your variable and trivial costs are the primary spots you can alter spending in the event that you have to.

Stage 4: Use A Budget To Transform Your Values Into Achievable Goals

Make an arrangement for accomplishing your short-, medium-and long haul budgetary objectives, and plainly list your qualities and how they line up with those objectives. Next, make your spending plan dependent on your salary, fixed costs and variable/superfluous costs. Audit these costs to guarantee they coordinate and add to you accomplishing your worth adjusted money related destinations. Fixed costs can be anticipated decently precisely, and by taking a look at your past ways of managing money, you can foresee your future. Following your spending plan on a worksheet that rundowns the means for accomplishing your budgetary objectives will assist you with remaining on target.

Stage 5: Adjust Your Value-Based Budget As Needed

In time, your pay and costs will move, similarly as your objectives may change. You should guarantee your qualities are as yet lined up with how your way of life and monetary propensities change. A few parts of what you esteemed when developing your family will move once you are centered around making the most of your brilliant years, while others may continue as before for an amazing duration. By taking a look at the worth based spending you made, you can have a superior image of how each bit of your budgetary puzzle fits in.

Adjusting Your Values To Your Financial Lifestyle

Making a worth based family spending requires some serious energy. Having a believed monetary advisor close by can help direct you and set objectives. Regardless of whether you don’t work with one, having lucidity on how your qualities, money related objectives and way of life adjust before you begin making a spending will help. As you adhere to your spending plan, your money related objectives will get simpler to accomplish.

(The data gave here isn’t venture, charge or monetary guidance. You ought to talk with an authorized advisor for guidance concerning your particular circumstance)

Most worthwhile projects or goals demand a few steps and perseverance in order to complete and accomplish. Projects that are complex take time, preparation is required for getting this done through numerous stages over an extended amount of time. Aiming to come up with a personal budget isn’t an exception. Creating a personal budget just isn’t a one step project either. However, here’s the way to achieve that in five simple steps.

Most people can’t even make a list of what they spend each month, because they have no idea what they spend their money on. No problem. Keep it simple. Get a pencil and a piece of paper, and carry them with you everywhere. Whenever you spend money, write in down. At the end of a normal week, you will have a good idea of where you spend your money.

Accommodation – It is good to pay your rent before anything else. You can not afford to live on the street. You are better off starving but no one will ever know. When your items are on the streets, the world will see. Landlords have specific dates by which they expect their money. They too make budgets of which your rent may be part of the source of funds to meet their needs. You can not suddenly think that you can put your own deadline disregarding the owner of the property. If you are living with parents, set money aside to buy your own house or condo. Set this money aside in an investment of some sort which you can access one day to pay deposit for a house or condo.

Groceries: you might need to estimate here, but on average, you generally spend about the same every month over the course of a year. And I generally include things in here such as household and personal products.

A budget allows you to easily track and control your spending and reduce stress. It gives you freedom from the stress of not knowing you have enough money to cover certain expenses. You are more in control of your finances. Besides, a family budget creates an environment of teamwork and communication in the family rather than one of stress and blame. It also get family members to be accountable for the spending decisions made and the financial goals you’re striving towards.

12 Budgeting Tips*

| 1 | Budget every month before the month begins |

| 2 | Budget to zero |

| 3 | Track every expense |

| 4 | Review your spending habits |

| 5 | Set a realistic budget |

| 6 | Make adjustments |

| 7 | Create a “Miscellaneous” category |

| 8 | Budget for annual and semi-annual expenses |

| 9 | Save for big purchases a little at a time |

| 10 | Budget for fun |

| 11 | Understand the difference between needs and wants |

| 12 | Give yourself grace |

Reference: EveryDollar.com

A Personal budget will do many things for you. Since we are talking about Personal budget, let’s see how http://babieboomers.com relates to it. The most important thing it does is let you make informed decisions about how you spend your money. It will show you exactly what you income and expenses are and lets you make adjustments to ensure a sound financial future.

You can also use your newly created budget to start prioritizing your debts and which need to be paid off first. This gives you a game plan to get out of debt while actually being able to see positive results, which is a major part of good money management.

First, write down all your expenses. Make sure you go further than just bills or monthly expenses. There are also weekly, daily, bi monthly, quarterly, bi annually, and annual expenses. This list should include all of your necessities even oil changes, car repairs, doctor visits, and everything else that is necessary that you spend money on.

After you know what your financial responsibilities are each month, you can allocate money for spending on things like eating out, movie tickets, getting your hair done, gifts, and other things like that. This also gives you a chance to see how much you have left so you know how much you can and should be saving to meet your goal.

If you need some heavy accounting power, you often can buy it for just a little investment. The problem is that the powerful home accounting software often comes with a large learning curve. If you have a small business or rental property you likely need some serious accounting power. Otherwise leave the powerful accounting packages to somebody who really must spend the hours it takes to learn a system.

Many people like to pay themselves first. Rather than putting the left-overs into savings, they decide on a percent that will go to savings prior to other expenditures. Most financial experts will suggest this as well. If you pay a tithe to a church, you may plan to do the same as well.

6 Steps To Finding A Great Financial Adviser

1. Get Advise

You can get a one through the National Association of Personal Financial Advisors. A Certified Financial Planner (CFP) is a generalist who ought to have the option to assist you with your entire budgetary picture. The Chartered Financial Analyst (CFA) assignment shows specific aptitude in contributing. A Certified Public Accountant (CPA) is a must. Also, a Chartered Financial Consultant (ChFC) has broad knowledge in your financial protection.

3. Be exacting. Become more acquainted with a few advisors before choosing one. Individual science matters, and there’s no point spending your cash on guidance from somebody with whom you don’t feel comfortable. Most consultants will give you a complimentary initial meeting – so as to go over your needs, their cycle and what you can anticipate that their administrations should cost – before you make a decision. Exploit these meetings.

4. Pose the extreme inquiries. You need to get a total image of a counsel’s experience, explicit aptitude, expenses and venture reasoning. Don’t hesitate to request references to his customers. Before you consent to a proper arrangement, ensure you and your counsel see precisely what administrations the individual in question will give and how long you anticipate that your relationship should last. What’s more, specify whether you can get a full or incomplete discount if your relationship closes early.

5. Dodge another Madoff. On the off chance that you are searching for somebody to deal with your money for you, consult with a consultant who is an overseer. Indicted double crosser Bernard Madoff held customer assets in his own guardianship, which is the way he had the option to deplete customers’ reserve funds and fudge their record proclamations. In the event that your counselor utilizes a free caretaker, for example, Charles Schwab or Scottrade, those organizations will claim your cash and your record articulations will originate from their workplaces (instead of from your adviser’s).

6. Do a record verification with controllers. A counselor’s Form ADV will let you know whether the person in question has any closeted skeletons. In the event that your guide is likewise enlisted as a representative, you should look at the person in question at www.Finra.Org/brokercheck. At long last, you can contact your state protections controller and ask any expert associations to which your consultant has a place, (for example, the CFP Board or the American Institute of CPAs) on the off chance that the person has a disciplinary history.

Here are 12 steps to make a budget; CLICK HERE

I have a GREAT Course for you on Budgeting for Beginners! CLICK HERE