How to Get Debt-Free Living

Many people are struggling under the burden of debt and are having problems bringing order to their finances. Arguments between spouses increase, as do stress levels. Often, they may feel they are on a treadmill, barely maintaining their current positions but making no progress at all.

Include a line item in your budget for savings, something that is often neglected in money plans. Set some target percentage to save, since even 3% of your income is better than nothing. Over a period of time, gradually increase the percent going into savings until it reaches at least 10%. Savings accounts, when reserved for true emergencies, are an important part of personal finance security. They mean you do not need to pull out a charge card if the hot water heater breaks or your car needs a repair. This in turn means that you are not increasing your debt load.

If you know where your money is being wasted you now have an opportunity to do something about it. You will also be able to understand how you can change your methods to get the same results while spending less money.

Try and consider exactly what you can do with all that ‘lost’ money you are about to find. With your budget prepared and with this additional money coming in you will be better off financially almost at a stroke.

If you ‘don’t know where your money is going’, write down every expense every day for a month… or get a receipt for everything you spend money on. One of the wealth masters discovered he was spending $350 on taxicabs before it struck home that he needn’t be broke because of that avoidable expense.

That is a very difficult condition to be in. If you are wondering if http://babieboomers.com has enough experience with personal finance you should check how long they have been around. So it is highly advisable to avoid debt at any cost. The only way out is devising a personal finance plan. If you can make an excellent budget for yourself, then you will surely find yourself spending less on things that are actually unnecessary. Avoiding this expense on unwanted things is the first step to financial security.

10 Steps to Be Debt-Free in Less Than a Year*

| 1 | Bump up your debt repayment percentage |

| 2 | Use savings to pay down larger debts |

| 3 | Negotiate for a lower interest rate |

| 4 | Use your tax refund check to pay down debt |

| 5 | Sell items for cash |

| 6 | Consider cashing in your life insurance |

| 7 | Make more money |

| 8 | Do a credit card balance transfer |

| 9 | Use a statute of limitations law to eliminate old debt |

| 10 | File bankruptcy to discharge your credit card debts |

Reference: AARP.org

Take a look at your investments. If it’s been a while since you did any financial shifting of assets, it might be time to do that. With the changes in the economy, what used to be a good safe bet, and what used to earn lots of interest per year, has changed.

I am sure that you are working very hard to pay off your bills. However, your bills seem to never get smaller. Actually, it looks like they keep growing! You are not sure what is happening here, but you feel very exhausted working to pay all the bills. You feel like you can’t do anything you want, no matter how hard you work. You feel upset and even despair. You feel inadequate, shame, and don’t know what to do.

You will also be able to maximize your savings and investments if you are able to follow your budget properly. You will be able save a lot of money that you usually waste on unwanted products, entertainment, gambling etc.

It’s never too late to take charge of your personal finances. You will still benefit from the investment no matter what age you start than if you never did. The earlier that you start, the better, but it is never too late to begin.

Using what I just outlined will help you gain the most bang for your buck, avoid the unnecessary and redundant purchases, save you time and help you keep more of your money in the bank.

Powerful Tips and Tools to Get Out of Debt

Here is one of the most often posed inquiries in all of individual money: “How would I escape obligation?” At one level, killing obligation is essentially about after a couple of steps:

*Quit going into more obligation

*Spend short of what you make

*Pay off debt obligation

On the off chance that you follow these means, in the long run you’ll be without debt. The issue is that following these means isn’t generally so natural. Also, to exacerbate the situation, there is a ton of “help” out there that is not exceptionally accommodating. There are a great deal of guarantees being made that escaping obligation. It’s most certainly not.

Truth be told, handling your obligation might be probably the hardest thing you’ll ever do. You need to control your feelings, which can have a major influence by they way we settle on monetary choices. You need to teach yourself about everything from home advances to Mastercards to FICO ratings. What’s more, you need to teach yourself in the manner in which you oversee and go through cash. The truth of the matter is that controlling your spending and taking care of your obligation isn’t a simple activity. In any case, fortunately you can do it.

Furthermore, to assist you with arriving at your objective, I’ve collected top notch of 23 hints.

Become more acquainted with Your Debt

The initial phase in handling any issue is to completely get it. With regards to obligation, you should have a deep understanding of the terms of the cash you owe. Here are a few hints and instruments to assist you with understanding your obligation.

Put Your Debt In writing: The absolute initial step is cause a rundown of the obligations you to have. The rundown ought to incorporate the accompanying data: The name, address and telephone number of the loan boss; the exceptional equalization; the financing cost; the base installment; and some other data you feel is significant. Indeed, even in the time of PCs, I like to work out my obligation on paper, at any rate from the outset.

Get Personal Finance Software: By now numerous individuals as of now have and utilize individual account programming like Quicken. Assuming this is the case, you can utilize the apparatuses inside the product to record the entirety of the obligation you owe and to build up an arrangement to take care of that obligation.

Utilize Free Online Tools: There are many spending devices accessible online for nothing. These apparatuses can follow your obligation and are anything but difficult to utilize. What’s more, it’s difficult to beat free!

Utilize Free Excel Templates: Microsoft offers free Excel layouts that can assist you with following your obligation and a financial plan. As a matter of fact, Microsoft offers free formats for pretty much everything, including resumes. You can look at the free spending layouts here.

Include Others: It’s significant that your companion or critical other is associated with the cycle. In the event that you don’t agree on accounts, it can make escaping obligation considerably more troublesome than it as of now is. It’s normal for one life partner to start to lead the pack in taking care of accounts, and that is fine. Yet, you both ought to be ready, especially as you build up an arrangement to handle the obligation.

Make a Plan to Pay Off Your Debt

After you’ve recorded every one of your obligations, it’s presently an ideal opportunity to decide how you will approach covering off these tabs. A strong arrangement ought not be muddled. It’s essentially your way to deal with handling your obligation. There is nobody single methodology; you have to do what works best for you and your family. There are, in any case, some significant contemplations and instruments that can assist you with building up a compelling obligation reimbursement plan:

Obligation Repayment Calculator: As a beginning stage, it’s useful (and once in a while agonizing) to perceive how long it will take you to take care of your obligation on the off chance that you make only the base installments. Also, there is a free obligation reimbursement mini-computer that is anything but difficult to utilize. While the arrangement will include making additional installments, the beginning stage is to comprehend what you are facing making only the base installments on your obligation, and this number cruncher will assist you with doing exactly that.

Set up a Budget: For some, “financial plan” is the feared “B” word. In any case, the truth of the matter is that you need a financial plan to control your going through and better deal with your cash. Recollect that it’s the cash you don’t go through every month that will go toward squaring away your obligation. Here are a couple of spending plan related articles that can kick you off:

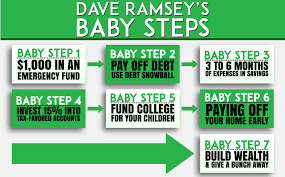

Be Aggressive About Paying Off Debt: Dave Ramsey discusses handling obligation with “gazelle” power. It’s tied in with being forceful in taking care of your obligation. As you work through your financial plan, perceive that each dollar tallies, and that the more you toss at your obligation, the less premium you’ll pay and the quicker you’ll escape obligation.

Be Realistic About Paying Off Debt: While we as a whole need to escape obligation quick, we do need to be mindful so as not to get excessively forceful. Taking care of obligation is a ton, like starting a better eating routine. You can focus on never eating food that are terrible for you, however is that reasonable? The idea of never eating frozen yogurt is simply an excessive amount to shoulder. The equivalent is valid with obligation.

Request Your Debt: With your spending plan set up and a comprehension of how much additional cash you can put towards obligation, it’s presently an ideal opportunity to delineate a particular arrangement. The inquiry is this–which obligation will you put your additional cash toward first? The principal thing isn’t to get too hung up on this inquiry. Contingent upon your circumstance, one methodology might be superior to another, however on the off chance that you reliably pay down your obligation without causing more obligation, you’ll gain incredible ground paying little heed to which obligation you pay first. All things considered, here are the main three ways to deal with concluding how to handle your obligation:

Pay Down the Highest Interest Rate First: With this methodology, you put all the additional money you have on the obligation that has the most noteworthy loan fee. This methodology will bring about the least intrigue charges and the quickest obligation reimbursement conceivable.

Pay the Littlest Balance First: This is the Dave Ramsey approach. He proposes focusing on the obligation with the littlest parity first. While that obligation might not have the most noteworthy financing cost, the hypothesis is to get one obligation paid off as quick as could reasonably be expected. The justification is twofold. To begin with, taking care of an obligation gives you a sentiment of achievement, which might be only the inspiration you have to keep on target. Second, by paying of an obligation totally, you let loose the money that was expected to make regularly scheduled installments to that bill. While you are probably going to put that money to the following obligation, in a crisis, you could utilize it for different purposes. As such, by paying the littlest obligation first, you free up income.

Non-Revolving Debt First: While many discussion about the two methodologies over, barely any glance at the kind of obligation when choosing which one to pay first. Review that spinning obligation, similar to Visas, permits you to obtain again after you’ve squared away the obligation. Non-rotating obligation, similar to a vehicle or school advance, doesn’t allow you to obtain again as you pay down the obligation. With a vehicle advance, when the obligation is paid, the credit is no more. With a Visa, when the obligation is paid, the card is still there to utilize again on the off chance that you so picked. Consequently, I’ll frequently concentrate on non-rotating obligation first. Why? Since I can’t go out and energize the obligation again once it’s paid. This is simply a mental issue, however a significant one, especially in the event that you dread you may do not have some control once a portion of your obligation is paid off.

Remember Your Emergency Fund: A rainy day account is a truly significant aspect of an obligation disposal program. While you might be enticed to put 100% of your additional money toward obligation, keeping probably some of it aside for crises will help break the dependence many have using a loan. At the point when the vehicle needs new tires, it’s smarter to go to the just-in-case account than it is the Mastercard. I’ll additionally include that while you can utilize a high return investment account for your backup stash, a present moment, high return CD might be the better wagered. While most CDs do charge a punishment if reserves are pulled back before the finish of the term, that punishment can help shield you from getting to the assets for something besides a genuine crisis. What’s more, there are transient CDs accessible with 3 or even 1-month terms.

Improve Your Credit Score

At the point when numerous individuals consider credit reports and financial assessments, they consider them to be significant on the off chance that you need to apply for an advance. What’s more, obviously they are significant when you apply for a credit. Yet, your credit report and score are additionally totally basic to disposing of obligation. With a decent FICO assessment, you fit the bill for lower financing costs that can help cut down your absolute intrigue charges. With terrible credit, you’re stuck paying twofold digit rates. So we should see a few hints and instruments that can support you:

‘Self’ is a one of a kind organization that assists you with building your FICO rating. Rather than applying for a charge card which has high expenses or a high financing cost, ‘Self’ has made a path for you to expand your FICO rating through a self subsidized advance. After you’ve applied for your advance and chosen an installment alternative, you’ll be on the way to building your credit.

Comprehend the Importance of Your Credit Score: As noted over, your FICO assessment is a significant instrument in escaping obligation as fast as could be expected under the circumstances. To underscore this, look at these details from myFICO.Com for people with a FICO score of 660 (reasonable credit) versus 760 (amazing credit):

Here are 9 more practical steps to solve financial problems, Click Here

I have a GREAT video series on Getting Debt Free! CLICK HERE