BUILDING WEALTH – Part 5

Building Wealth-Part 5

By Gary John

In the past series I discussed how to build perpetual wealth, the reasons for diversifying your investments, how to approach diversification, and how to leverage different asset classes and diversification strategies to increase your wealth and ensure your personal prosperity, and how to tax-shelter your wealth.

(As a disclaimer, I am not a CPA, lawyer, or financial planner so it is in your best interest to seek differing opinions on the topics I present, so you can make your own decisions)

Now I want to discuss in more detail about Dividend Stock.

Dividend Growth Investing: The Boring Predictable Path to Wealth

Dividend stock investing is one of the oldest and surest ways to grow your wealth and income over time. It is one of the best ways to guarantee an income before and after retirement. After you start investing in dividend stock you will use the power of compound interest in order to grow an income-generating machine that can help you live in comfort and security forever. Did you know Albert Einstein was once asked what mankind’s greatest invention was, he replied: “Compound interest.” There’s even one claim that Einstein called compound interest the “8th Wonder of the World.”

Dividend investing is such a powerful way to build wealth, and it has been used by the financial savvy to secure their retirement for centuries. It is simple to do and simple to run. It’s almost a set-it and forget-it type of system. If done properly (that’s the key…) it is such a great money generator you don’t understand why millions aren’t doing it. I remember when Grandpa would get those dividend checks he had a smile on his face, and I thought it was just an old person thing but I wanted to hit it BIG doing something different. I have to admit it, he was right! Dividend investing is darn-right boring! But when you see the checks roll in regardless to the economy it is just amazing. No other investing approach combines consistent returns with below-average risk and simplicity.

What actually is a dividend?

- A dividend is the distribution of some of a company’s earnings to a class of its shareholders, as determined by the company’s board of directors.

- Dividends are payments made by publicly-listed companies as a reward to investors for putting their money into their company.

- Announcements of dividend payouts are generally accompanied by a proportional increase or decrease in a company’s stock price.

What about investing in non-dividend stock? According to Vanguard, US stocks are likely to produce between 5% and 8% per year over the next decade. Sounds good, right? But most Americans invest in actively managed mutual funds and the average fee is 1.2% per year. Therefore, the best case annual return for most investors is between 2.6% and 5%. But this doesn’t tell the whole story. How about the typical investor who thinks he can beat the market. There are psychological traps, triggers, and misconceptions that cause investors to act irrationally. That irrationality leads to buying and selling at the wrong time which leads to underperformance. The average investor did worse than the S&P 500 by approximately 2.9% per year. This results in an average performance by investors at 2.1% per year

And what about the wild swings in the market. What about average Joe American who is either near retirement or retired. He was told by his financial planner to withdraw 4% per year from his portfolio to live on. The problem with this idea is the reality that if the market down-turns 20%-30% like we just had and Joe American continues with his 4% withdrawal he could be out of money in 5-10 years. Some people can adjust their drawal rate but a lot of people have fixed expenses and they have to withdraw the 4%. This can put them in a world of hurt!

How about bonds? Everyone tells us to buy more bonds as we get older. In the past, 10 year bonds were 4.42% but now they are at 0.78%. With inflation near 3% you will actually lose 2.22% if you buy bonds now. And another problem is the fact that they are fixed at this rate for 10 years.

Here’s my investment strategy:

- Your portfolio should grow your wealth reliably over long periods of time (i.e. lifetime)

- Your portfolio should minimize the volatility of the market

- Your assets should generate enough money to pay your bills

- This passive income should grow at least as fast as your expenses and keep up with inflation

- Your money-generator should be easy to start and easy to follow

Here are some basic principles of buying dividend stock:

Not all companies give out dividends so seek out companies that do. You can easily do a google search for them, i.e. type in ‘dividend stock’ and you will see quite a few.

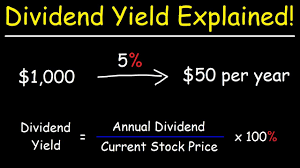

Check out the dividend yield and payment (go to Yahoo finance). You may think the higher the yield the better but many high yield stock may be junk, companies that want to lure you in to buy them but later defaulting from bankruptcy. Instead, you want to focus on well-known and established companies like AT&T or IBM.

Another factor is longevity. We want companies that have been around a long time and will be here for a long time. Some of the companies I invest in have been in existence for 50 years.

As a note, the yield is given in terms of share price; it’s constantly changing day to day and even throughout the day as share price changes.

Many companies are going to try and keep their yield constant or within a specific range. They do this in order to attract investors who like dividend stocks, because a stable yield is attractive as a sign of stability.

Look at a stock’s dividend history. Check out Seeking Alpha.com. This is a great free site that I use often. Select ‘Dividend’ and you can see the dividend history. Companies that try to pay consistent dividends even when tough economic times are going to be better investments than companies that reduce their dividends.

Check out the payout ratio. This is the dividend paid per share / earnings per share. This is important because it gives you an idea on how able the company is to pay the dividend. With exception to utility companies this ratio should not be over 60%. In other words, they have amble reserves to keep giving out their dividends.

A real important metric is dividend growth (see seeking alpha.com). You want to see an increase in their annual dividend growth. As a general rule, larger dividend payers may not have a large dividend growth as compared to the smaller payers but you definitely do not want a reduction in dividends.

There are two ways to gain wealth as a dividend investor. The first way is the quarterly dividends you receive. The second way is the acquired wealth through normal appreciation of shares over time. When the value of the shares increases, you are going to increase your wealth. Also, if the company works to keep its yields consistent, your dividend payments should also increase. So, keep on buying as many shares as you can and reinvest the shares every quarter. So, looking at numbers, if you have $1,000,000 invested, getting a 6% dividend, will net you $60,000 every year. And you will retain the principle balance of $1,000,000!

| Metric | Preferred |

| Using Yahoo Finance: | |

| Want low P/E | <20 |

| Want high EPS and growing | >6 |

| Want increasing sales | >10% |

| Want low Beta | <1.0 |

| Is the stock Going up? | Yes |

| Is there Brand recognition? | Yes |

| Using Seeking Alpha | |

| Want low payout ratio | <60% |

| Want no decline in Dividend Yield History | No |

| Want Dividend Growth in History | >10% |

| Want Dividend History Going Up | Yes |

| Want Revenue and Net Income going up | Yes |

So, you can see that just finding companies that pay dividends is not enough. Don’t be seduced in buying a high dividend stock. I would say anything over 6-7% may be suspect. The best strategy is to look for companies that not only pay a dividend but those that have a high probability of continuing to pay one in the future and growing it each and every year. These established companies will build long-term wealth for you! Keep buying them and let compounding do its magic.

As a starter, you should google ‘Dividend Aristocrats’ and ‘Dividend Kings’. Dividend Aristocrats are a select group of 65 S&P 500 stocks with 25+ years of consecutive dividend increases. Dividend Kings are S&P 500 companies who have increased their dividend for 50+ consecutive years. That is an amazing record of consistency. That is why there are only 29 companies that qualify for the Dividend Kings List.

To make things simple for beginners:

- Focus on Dividend Growth more than Dividend Yield. A stock with a 2% dividend yield and 10% dividend growth will ultimately produce more dividend income than a stock with a 6% dividend yield and no dividend growth.

- Pay Attention to Payout Ratios. Dividends ultimately are paid out of cash flows. A company that pays out more in dividends than it brings in will eventually be forced to reduce the dividend.

- Watch out for Financial Wolves. There are a lot of companies that recognize how attractive the dividend is for investors. To support their stock price they artificially jack up their dividend. You can tell by using the research tools I gave you. You need to check out a company’s history. If there is something out of norm from their history something is wrong.

- Pay Attention to Stock Prices. It is true that prices will drop if there are bad economic times. But if the price drops during ‘good times’ there may be something wrong with the company (maybe Amazon is hurting their business). The old saying: ‘Don’t try to catch a falling knife’.

Stay tuned for Part 6 where I will give you an Easy Simple Way to Buy Dividend Stock!

Related Posts

-

Never Mess With Self Esteem And Here’s The Reasons Why

No Comments | Jul 26, 2020

Never Mess With Self Esteem And Here’s The Reasons Why

No Comments | Jul 26, 2020 -

BUILDING WEALTH -Part 6

No Comments | Oct 26, 2020

BUILDING WEALTH -Part 6

No Comments | Oct 26, 2020 -

BUILDING WEALTH – Part 1

1 Comment | Oct 17, 2020

BUILDING WEALTH – Part 1

1 Comment | Oct 17, 2020 -

BUILDING WEALTH – Part 4

1 Comment | Oct 21, 2020

BUILDING WEALTH – Part 4

1 Comment | Oct 21, 2020