BUILDING WEALTH – Part 2

Building Wealth-Part2

By Gary John

In this series I would like to discuss how to build perpetual wealth, the reasons for diversifying your investments, how to approach diversification, and how to leverage different asset classes and diversification strategies to increase your wealth and ensure your personal prosperity, and how to tax-shelter your wealth.

(As a disclaimer, I am not a CPA, lawyer, or financial planner so it is in your best interest to seek differing opinions on the topics I present, so you can make your own decisions)

In part 1 we learned that many people are going to take a financial hit when they retire. This is due to fact they either didn’t save enough, their pension went bust, they trusted an ‘advisor’ to invest for them, or they thought they could retire just on social security.

Are you ready for wealth? There are certain principles you must understand first:

1. You need discipline to acquire wealth. It’s not a set it and forget it process. Like any goal, you must follow through and don’t give up. You need to Dream Big.

2. You must surround yourself with a ‘like kind‘. You need friends with good positive attributes and have high aspirations. You will become like them and they will become like you.

3. It’s the Love of Money that the Bible warns about. It’s not money itself. We need money for our essentials, help our kids and grandkids, be beneficial to society, give to charity, and not be a burden to anyone. Money doesn’t make you a bad person; you will be bad with or without it! Money is NOT the root of evil but I think it is the other way around. I believe the lack of money causes much evil.

Here are the key differences of the wealthy:

1. The wealthy have a different mindset. Instead of saying, ‘I can’t afford that’ they say ‘how could I afford that’.

2. The wealthy have financial education. They make it a priority to learn about money, finance, and investments.

3. The wealthy understand it’s not how much you make, but how much you have left to invest. I am sure you have heard, ‘you need to pay yourself first’. What this means is you need to automate a withdrawal of 10-15% from your checking account to your investment fund. I know Schwab can do this. Trust me, you won’t miss a dime! Read the book, ‘Automatic Millionaire’ by David Bach.

4. The wealthy buy income producing assets (more on this later).

5. The wealthy work on building cash flow streams of income.

6. The wealthy focus on continuously building their wealth.

7. The wealthy make their money work for them.

8. The wealthy limit their liabilities; or better yet they have their positive cash flow assets buy them.

9. The wealthy take responsibilities and don’t blame others.

10. The wealthy take action.

11. The wealthy learn from failure, and move on.

12. The wealthy take calculated risks.

If you want to become wealthy, you need to make it a priority to educate yourself. Learn from the wealthy. Learn from those who have succeeded. Don’t learn from the TV or your peers that are struggling, or you will sabotage your efforts in achieving lasting wealth.

Since financial education is key to wealth, here are some ways to get educated (remember, constant learning is a key component of life the wealthy people seek):

1. Of course, go to http://babieboomers.com. I will adding a lot more wealth-building information constantly, search my website frequently.

2. Reading financial education books.

3. Attending professional seminars.

4. Watching YouTube videos on investing.

5. Listening to pod casts from successful people.

Why ‘Saving’ Money Won’t Make You Rich:

Inflation reduces the purchasing power of savings. When the cost of living goes up your purchasing power diminishes over time. Yes, it is true that we need an emergency fund but don’t think of it as an investment account.

The federal government prints money like no tomorrow to paid its huge debt. This makes money worth less.

You actually lose money putting it in a savings account. Think about it; they pay you 1% but inflation is 3%; you actually lose 2% by putting it in a bank.

Similar to building a house, you need to first have a good financial foundation before building wealth. You first must free yourself of financial liabilities. This means paying off bad debt (i.e. credit cards), developing an emergency savings account, and building an opportunity fund for investments.

Credit cards are potentially evil. It is so easy to ‘charge’ it but we pay the consequences at the end of the month. If anything, pay down the full balance at the end of the month. Have you noticed on your credit card statement, they print ‘Minimum Due’ in large font but the full balance due in smaller font. That’s because the card company wants to rip you off with their outrageous fees and interest rate.

As far as the Emergency Fund. They say to have at least 3 months of living expenses in there (some say, 6 months). You could put this in a high interest savings account (see Bankrate.com).

Basic debt reduction steps:

1. Reduce your discretionary spending.

2. Lower your expenses.

3. Increase your income.

4. Use any money left over to pay down your debt.

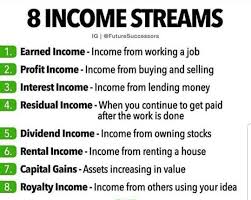

There are many types of income:

1. Earned Income: this is when you work for someone else. Little tax benefit.

2. Business Income: Has tax benefits.

3. Residual Income: this is where you no longer are active in the business

4. Dividend Income: some companies offers stock dividends

5. Rental Income: money you get from residential or commercial property

6. Royalty Income: This is from licensing a product, brand, idea, TV, music

7. Capital Gains Income: This is from selling stock, properties, fixed assets.

Note: having multiple streams of income of different types is ideal for ensuring the fastest route to building wealth.

The KEY TO WEALTH = ASSETS. ASSETS, ASSETS

What is the definition of an asset? Simply stated, it is something that puts money in your pocket. Is your house an asset? Well, yes and no. In the short term it is not, with all the money needed to support it, i.e. mortgage, utilities, property taxes, and maintenance. It only becomes an asset when you sell it. The best assets you can have are those that have a positive cash flow, putting money in your pocket. Examples of these are: rental properties that produce positive rental income, businesses that profit, and stocks that pay dividends.

CASH IS KING

Cash flow is the golden key to building and preserving lasting wealth. Each asset that produces money is like a bank printing you money. This is the key to wealth. Having positive cash flow from my investments means that I am essentially generating my own money. Or more correctly, my investments are making the money. This is where the term Perpetual Wealth originates.

The second thing wealthy people do is never selling the principle. As you spend the principle or sell assets, your cash flow generating capabilities decrease. This is a recipe for diminishing your wealth and should be avoided at all costs! Only spend the interest and earnings you receive.

What should my income allocations be? Dan Lok, a successful entrepreneur, suggests this allocation:

*60% for living expenses (mortgage, utilities, taxes)

*10% for ‘fun money’ (clothes, eating out, vacations)

*10% for investing in yourself (self improvement, education)

*10% for buying assets

*10% for savings (emergency fund)

In conclusion, the wealthy do not work for money. Instead, the wealthy work to acquire assets that generate money for them. In this way, the wealthy do not have to trade their time for money. Once a person acquires enough cash flowing assets that generate income that exceeds their expenses and they do not spend the principle, they have achieved true wealth.

Stay tuned for Part 3 where I will discuss assets that produce cash flow.

I have not checked in here for some time because I thought it was getting boring, but the last several posts are good quality so I guess I’ll add you back to my daily bloglist. You deserve it my friend 🙂